“Never go broke again”? It almost sounds impossible right?

No it’s not!

You’re just missing out on a secret that you know about but you never practice.

Now, you’re curious- what could this secret be?

If you find out right now, you will experience the “Aha moment” and that’s where it’s gonna end.

You’ll go back to being broke again and the secret you already knew will be long forgotten.

To avoid that disaster let’s go back to the beginning…

Why does the word broke even exist?

What does it mean to be broke?

If you can’t afford your favourite designer brand’s recent release does it mean you’re broke?

Or perhaps if you can’t afford a luxurious vacation, are you broke?

Well that’s a question you’ve got to answer for yourself.

No one knows you as much as you know yourself, you can lie to everyone else but you can’t deceive yourself forever.

No matter how long you try to live a lie, you always know the truth.

And to answer your question, here’s what the English dictionary says about “being broke”

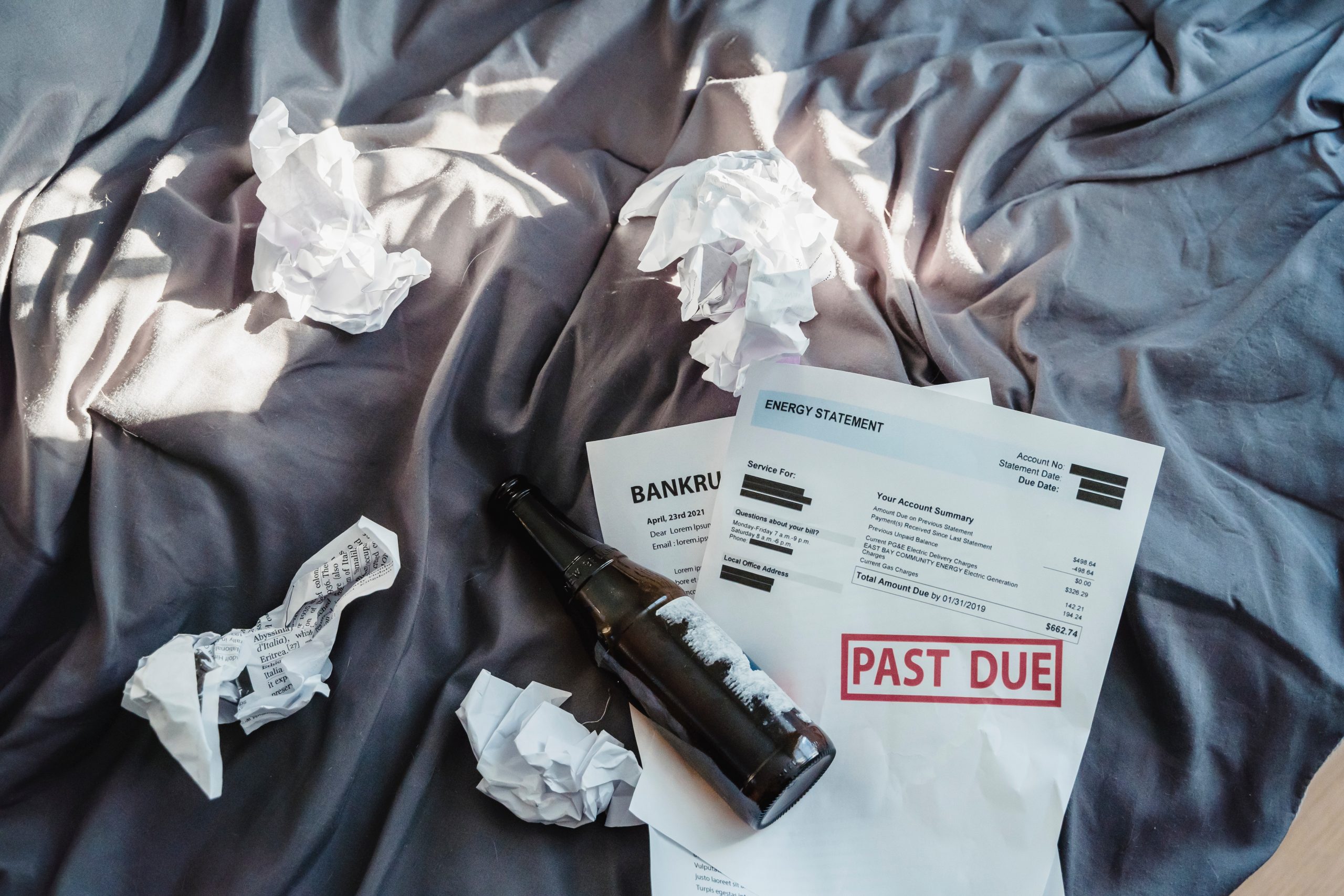

“Financially ruined, bankrupt,without any money, penniless”.

You’re broke when you can no longer provide your primary needs -shelter, food and clothing.

Nowadays, a lot of people use the word “broke” whenever they are low on cash but there’s more to the word than a negative bank account.

It’s a state of financial crisis that you never want to get into.

You can choose to go broke- yes or no?

You’ve probably heard someone say – “going broke is a choice”

You didn’t agree, right?

How can someone make such a foolish decision to be out of cash and unable to take care of their needs?

Yes, you are right in a way however there’s a weak link.

You may not choose to be broke, but the little actions and decisions you make everyday makes that choice for you.

For instance your monthly salary is $500, below is a breakdown of how you send your salary.

- Groceries – $150

- Water/electricity/data bill = $70

- Clothes = $200

- Fast food = $50

- Balance =$30

You’ve $0 for savings, investment, emergency or any other miscellaneous expenses.

What will happen if your company has an issue and can’t afford your salary?

Or what if you get fired? How do you feed or pay the rent when you’re out of a monthly income source?

With no salary, no investment and no savings,you are the perfect definition of the word “broke”

But it’s a good thing that with the right information, you can choose to never go broke again.

There are 5 things you must remember to never go broke again;

1. It’s a personal decision

You can choose to be broke or not!

Yes, life can be tricky, it comes with hard times that you can never imagine.

But that’s life, it’s doing its job.

The real question is, what are you going to do with the tough times you face?

Will you end up pitiful or powerful? Will life get you broke or will you fight hard to build your finances?

2. Get your head out of the gutters

Talk to every successful person you know today and they’ll all say one thing…

It begins and ends in your mind.

If you’re gonna be broke, that’s what you have accepted as your future and reality.

But if you refuse to settle for mediocrity and choose to believe that success is yours that will be your starting point to the top.

Dream big, think big, see big and with hard and smart work you will never be broke again.

3. No one is coming to save you

You need to save yourself first before anyone can choose to offer a helping hand.

Stop lying in dark, crying your eyes out and wishing for help to find you – it may never come.

Find the strength you need to heal, pick the remaining crumbs of your life and start over.

The moment you choose to stand tall and fight for yourself, help will naturally gravitate to you.

4. It’s faster to cut a tree than grow one

It’s going to take some time, weeks will turn into months and months into years.

You need to keep going!

No matter how long it takes, never forget that slow progress is still progress.

5.Your mental health will take a hit

Nothing suffers as much as your mental health when you’re broke.

In this phase of your life, you will be drawn to people, spending, partying and living their best lives.

It’s going to take a high level of self-discipline to avoid comparing your life with theirs.

Anxiety, low self esteem, depression and even anger will become your companion for a while.

But here’s a plea – Don’t let it consume you.

Are there things to do to never go broke again?

If you’ve ever been broke, the thought of going back would be scary.

And if you have never been broke – don’t even imagine it, it’s not fun.

To never go broke again or never experience being broke in your life, here is what you wanna do…

-

Plan your spending

Nothing screams “going broke soon” louder than regular unplanned spending.

You can be the richest person on earth but a poor spending habit will get you broke.

Here is what you wanna do..

Every month write down all the things you spend money on and how much you will spend on them.

Your estimate might be wrong in the first two months, it’s best to keep extra cash to balance your miscalculation.

You should get it right by the 3rd or 4th month.

Stick to your budget, whenever you exhaust the allocated money that’s where your spending should end for the month.

-

Avoid financial competition death trap

Life is not a competition, it’s a free world and anyone with the right effort can emerge as the winner.

Don’t buy things to keep up with your friends, buy what you need and what you like.

It’s your life and your money,don’t let the financial competition death trap get you broke.

-

A “me-day” won’t hurt you

A Self-care or “pamper myself day” will not get you broke.

You deserve a treat, so once in a while indulge your cravings, get the bag, order the shoe, plan a trip with friends.

Don’t forget all work and no play makes Jack a dull boy

-

Avoid emotional shopping

Some people spend more on food when they’re sad and others on their favorite designers when they are happy, frustrated or annoyed.

Are you an emotional spender? Do you feel the need to spend more whenever your emotions are high?

This could be leaving a huge dent in your bank account.

You can’t always control your emotions, but you can control your actions.

Replace your emotional spending habit with a new habit like – cooking, streaming songs/movies, workout etc.

- Save! Save! Invest!

A savings account has saved a lot of people and you can be one too.

You might be unable to start an investment portfolio right but you save towards it.

A habit of saving 10% of your monthly salary can be an enormous help to you on a rainy day.

-

Have a scale of preference (Needs over wants)

Wants are limitless, you can never be out of wants but you can’t satisfy everything.

You need to prioritize your needs over your wants.

Needs are your food, rent, utility, savings and your wants can be your favourite fast food, fashion, vacation, hangout etc.

Know what should be at the top of the list and want you to scrap out.

-

Learn to say no

You don’t have to go shopping because everyone is going.

No, it doesn’t mean your life is pathetic, you’re simply fighting for a better financial status.

Of course you can say yes sometimes but never at your own risk.

If you can’t afford it, say so but if you can’t say the words “I can’t afford it” then make an excuse.

Conclusion

Everyone loves financial comfort, no one is in love with the idea of going broke.

But it happens! In fact, someone reading this right now might be broke.

You are not alone, there are other people who have been in this position and got out in a grand style.

You can be the next, you can choose to never go broke again.

It’s one thing to choose and another thing to put in the work.

You are my inspiration , I possess few web logs and very sporadically run out from to post : (.